In the past week, container freight from Asia to the United States and Europe hit a record high. For companies that are about to enter the peak season for rebuilding inventory, transportation costs will continue to remain high.

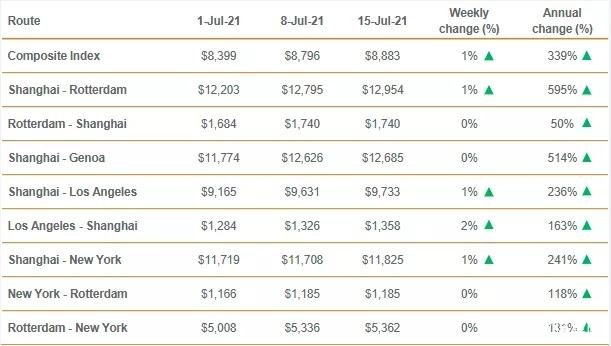

According to the Drewry World Container Index released on Thursday, the spot freight rate for a 40-foot container from Shanghai to Los Angeles rose to a record US$9,733, a 1% increase from the previous week and a 236% increase from a year ago. The freight rate from Shanghai to Rotterdam rose to US$12,954, a 1% increase from the previous week and a 595% increase from a year ago. The composite index reflecting the eight major trade routes reached US$8,883, a surge of 339% from a year ago.

One of the reasons for the tight market is the continuing shortage of containers carrying American imported goods on the busy trans-Pacific route. Containerized cargo is pouring into America's largest maritime trade gateway with five times the volume of containers full of export cargo.

In an interview with investors, the chairman and CEO of Haverty Furniture, headquartered in Atlanta, said: "Today, the backlog of containers, products, shipments, etc., and any of these products have been delayed. This is all Very serious." He said at an investor meeting this week.

When asked how long the supply problem is expected to last, Smith said: "It is said that the supply chain problem will last until next year. I don't think the situation will get better this year, maybe it will be better. We have to pay extra to get the container and space. ."

The port is still congested and it is getting worse

The Port of Los Angeles said on Wednesday that the total import volume of containers loaded in June was 467763 TEU, while the export volume fell to 96067 TEU-the lowest level since 2005. In the Port of Long Beach, last month's imports increased by 18.8% to 357,101 TEU, of which exports fell by 0.5% to 116,947 TEU. The total imports of the two ports last month increased by 13.3% compared to the same month in 2019.

At the same time, according to officials monitoring port traffic, as of Wednesday night, the number of anchored container ships waiting to be unloaded at Long Beach in Los Angeles was 18. This bottleneck has existed since the end of last year, reaching a peak of about 40 ships in early February.

Gene Seroka, executive director of the Port of Los Angeles, said at a press conference that demand for consumer products looks set to remain stable for the rest of the year. Seroka said: "Autumn fashion, back-to-school supplies and Halloween goods are arriving at our docks, and some retailers have shipped year-end holiday products ahead of schedule." "All signs point to a strong second half."

Mario Cordero, executive director of Long Beach, said that although the port expects e-commerce to promote cargo transportation for the remainder of 2021, cargo volume may reach its peak. Cordero said: "As the economy continues to open up and services become more extensive, June shows that consumer demand for goods will gradually stabilize."

The overview of the international market in the first half of the year can be briefly summarized as follows:

1. Significant increase in transportation demand

According to Clarkson's second quarter report, the growth rate of global container transportation volume in 2021 is about 6.0%, and it is expected to reach 206 million TEU!

2. The speed of new ships entering the market remained stable, and the large-scale ships continued to advance.

According to Clarkson's statistics, as of May 1, the number of global full container ships was 5,426, 24.24 million TEU.

3. Fleet rents continue to rise

The demand for ship leasing has grown steadily, and some cargo owners have also participated in leasing activities. The market rent level has steadily increased and reached a high level during the year.

The international market is expected to show the following characteristics in the second half of the year:

1. The economic rebound stimulates the increase in shipping demand. According to Clarkson's forecast, global container shipping demand will increase by 6.1% year-on-year in 2021.

2. The scale of transportation capacity continues to increase in size.

3. In the context of continuing to be impacted by the epidemic in 2021, the operational efficiency of the global shipping market will be greatly reduced.

4. The industry concentration is generally stable.

The alliance operation method avoided the industry from competing for market share through fierce price competition and maintained market stability during the epidemic.

Outlook for the Chinese market in the second half of the year:

1. Transportation demand is expected to continue to improve.

2. Freight rate fluctuations may increase. The epidemic continues to have an impact on the shipping market, the supply chain system is disrupted, the efficiency of port operations is greatly reduced, and the supply of transportation capacity is in a tight situation.

North American routes

Due to poor response, the number of confirmed cases and deaths of the new crown virus in the United States ranks first in the world. Although the United States has invested a huge amount of money to maintain the prosperity of the capital market, it cannot conceal the slow recovery of the real economy. The actual number of unemployed people far exceeds that before the epidemic. In the future, the US economy is more likely to break out of financial turmoil.

In addition, the continued Sino-US trade frictions may also have a greater impact on Sino-US trade. At present, the United States has issued a large amount of unemployment benefits, which has stimulated a large amount of demand in the short term. It is expected that China's export consolidation demand for the United States will remain high for a period of time, but it is facing greater uncertainty.

According to Alphaliner's statistics, among the new ships scheduled to be delivered in 2021, there are 19 ships of 10000~15199TEU with 227,000 TEUs, a year-on-year increase of 168.0%. The epidemic has caused a shortage of labor, a significant reduction in port operation efficiency, and a large number of containers are stranded in the port.

With the increasing investment in container equipment and the restoration of new capacity, it is expected that the current shortage of empty containers and tight capacity will ease. In the second half of the year, if the U.S. epidemic gradually stabilizes, China's exports to the U.S. are expected to remain stable, but there will be certain difficulties if they continue to grow sharply. The supply and demand relationship of North American routes will return to balance, and market freight rates are expected to return from historical highs to normal levels.

Europe-to-land route

In 2020, the epidemic broke out earlier in Europe and lasted for a longer period of time. Later, due to the outbreak of the mutant delta strain, the European economy was hit harder.

Entering 2021, although the epidemic continues to spread in Europe, the European economy has shown good resilience. Together with the unprecedented EU economic recovery plan adopted by the EU region, it has played a supporting role in the recovery of the European economy from the impact of the epidemic. In general, with the gradual slowdown of the epidemic, China's demand for European export consolidation is improving, and the market supply and demand relationship is stable.

According to Drewry's forecast, the westbound transportation demand in Northwestern Europe and North America will be approximately 10.414 million TEU in 2021, a year-on-year increase of 2.0%, and the growth rate will increase by 6.8 percentage points from 2020.

Due to the impact of the epidemic, the overall transportation efficiency has been greatly reduced, and some containers have been stranded in ports, and the market has shown a situation of tight shipping spaces.

In terms of capacity, the overall capacity of the market is currently at a high level. During the epidemic, capacity growth has been relatively slow. However, the new capacity will be mainly large ships, which will be mainly invested in main routes to partly alleviate the shortage of capacity. In the longer term, when the container shipping market recovers from the impact of the epidemic, the market will return to the balance of supply and demand.

North-South Route

In 2021, the epidemic will continue to spread all over the world. Countries have invested large amounts of money to push up the prices of commodities, and most commodity prices have risen to levels before the outbreak of the global financial crisis in 2008, partially alleviating the difficulties of resource exporting countries.

However, because most of the resource exporting countries are developing countries, the public health system is weak, and there is a lack of vaccines to control the epidemic. The epidemics in Brazil, Russia and other countries are particularly severe, and the overall economy has been severely impacted. At the same time, the severe epidemic has stimulated the demand for daily necessities and medical supplies.

According to Clarkson's forecast, in 2021, the demand for container shipping on Latin American routes, African routes, and Oceania routes will increase by 7.1%, 5.4% and 3.7% year-on-year, respectively, and the growth rate will increase by 8.3, 7.1 and 3.5 percentage points respectively compared with 2020.

On the whole, transportation demand on the north-south route will pick up in 2021, and the epidemic has reduced the efficiency of the supply system and tightened the supply of transportation capacity.

The north-south route market is supported by transportation demand in the short-term, but if the epidemic situation in the relevant countries is not effectively controlled, it will put pressure on the market trend in the long-term.

Japan route

After entering 2021, the epidemic in Japan has rebounded and surpassed the peak of the epidemic in 2020, so that the Tokyo Olympics may be held in a way that spectators are prohibited from entering the stadium. The huge amount of funds invested in the Olympics may face huge losses.

The epidemic has further hit the already weak Japanese economy, coupled with the increasingly serious structural problems such as an aging population, Japan's economic growth lacks momentum in the context of high debt.

The transportation demand of China's export to Japan routes is generally stable. In addition, the liner companies operating the Japanese routes have formed a stable business pattern for many years, avoiding malicious competition for market share, and the market situation remains stable.

Routes within Asia

Asian countries with good control of the epidemic will face an increasingly serious epidemic in 2021, and countries such as India have caused the epidemic to get out of control because of the delta mutant strain.

As Asian countries are mainly developing countries, the health and medical systems are weak, and the epidemic has hindered trade, investment, and the flow of people. Whether the epidemic can be effectively controlled will be the primary factor that determines whether the Asian economy can stabilize and rebound in the future.

According to Clarkson’s forecast, in 2021, intra-regional shipping demand in Asia will be approximately 63.2 million TEU, an increase of 6.4% year-on-year. Transportation demand has stabilized and rebounded, and shipping capacity supply on shipping routes will be slightly tight. However, the epidemic may cause greater uncertainty to future transportation demand. , The market freight rate may fluctuate more.

Post time: Jul-17-2021